)

Joe Dyton has been a professional writer since 1999. He's been writing about the auto insurance industry for 15 years and was an in-house marketing copywriter for GEICO for a decade. Learn more about Joe at joedyton.com.

)

)

Licensed property and casualty insurance agent

8+ years editing experience

NPN: 20461358

John leads Insurify’s copy desk, helping ensure the accuracy and readability of Insurify’s content. He’s a licensed agent specializing in home and car insurance topics.

Featured in

)

Amber Benka is a licensed insurance agent specializing in auto, home, commercial, life, and health insurance. She has owned the R.A.L Insurance Agency for four years.

Updated

At Insurify, our goal is to help customers compare insurance products and find the best policy for them. We strive to provide open, honest, and unbiased information about the insurance products and services we review. Our hard-working team of data analysts, insurance experts, insurance agents, editors and writers, has put in thousands of hours of research to create the content found on our site.

We do receive compensation when a sale or referral occurs from many of the insurance providers and marketing partners on our site. That may impact which products we display and where they appear on our site. But it does not influence our meticulously researched editorial content, what we write about, or any reviews or recommendations we may make. We do not guarantee favorable reviews or any coverage at all in exchange for compensation.

Table of contents

Cheapest Companies for Drivers With Bad Credit in Kentucky (2022)

For drivers with bad credit in Kentucky, it's important that you evaluate all of your potential insurance options to ensure you are finding the best rate. Comparing the right insurance companies will allow you to get the best possible insurance rate for drivers with bad credit.

To simplify comparing companies, Insurify has analyzed rates from top insurance providers in Kentucky. The following are the best insurance rates from carriers that offer car insurance for drivers with bad credit in Kentucky.

Carrier | Avg. Monthly Cost ⓘ |

|---|---|

| Travelers | $184 |

| SafeAuto | $201 |

| Midvale Home & Auto | $222 |

| American Family Insurance | $240 |

| Liberty Mutual | $246 |

| Bristol West | $264 |

| Safeco Insurance | $276 |

| The General | $310 |

Bad Credit Car Insurance in Kentucky

A poor credit score can negatively impact your financial future, especially when it comes time to apply for a car loan or mortgage. Did you also know that bad credit can lead to you paying more for car insurance? There are a few states that prohibit car insurance companies from considering a person's credit score when determining their rate, but Kentucky is not one of them. But a low credit score does not mean you'll be denied car insurance. You just might end up paying a higher insurance premium.

Fortunately, car insurance credit checks in Kentucky are considered "soft inquiries" and won't impact your credit score.

Kentucky Car Insurance Rates for Bad Credit Drivers

Insurify's comparison tool will help you make sure you're getting the best possible quote even with a bad credit rating. You can have peace of mind you're not paying any more than need to, and customers save $48 per month on average.

How Much Does Bad Credit Impact Car Insurance Rates in Kentucky?

Drivers with bad credit pay 13 percent more than average for car insurance in Kentucky. Insurers will use factors like your payment history and total debt to determine your insurance credit score, and in turn your risk level. Insurers want to assess risk to see how likely you are to file a claim in the future. Your credit-based insurance score is just one item companies look at to determine your rate, though. Your driving record and claims history will also be factored into your rate.

Can I Get Car Insurance With No Credit Check in Kentucky?

It's possible to get car insurance without a credit check in Kentucky. But just like having bad credit, insuring your vehicle this way can be costly. The reason many car insurance companies run credit checks is to help determine how much risk they're taking on by insuring someone. Without the credit check, the risk assessment is somewhat incomplete, so the insurer will charge a higher premium to compensate for that missing information.

You can avoid the credit check process with certain insurance companies in Kentucky, just know you might be paying more for coverage. Be sure to check out some standard insurers on your search, too. You might not want to deal with a credit check, but it might be worth it if you can save some money.

Kentucky Car Insurance Rates by Credit Tier

How much Kentucky drivers pay for their insurance lines up with their respective credit tiers. Drivers in the excellent credit tier in Kentucky are on the lower end of average monthly costs, with a $219 payment. There isn't much of a separation between Kentucky drivers with good or average credit, however. Drivers in the average tier pay just $6 more per month.

There are a number of reasons to maintain good credit, but the $51 difference between what Kentucky drivers with excellent credit and poor credit pay for car insurance is another critical one.

Credit Tier | Avg. Monthly Cost ⓘ |

|---|---|

| Excellent | $219 |

| Good | $237 |

| Average | $243 |

| Poor | $270 |

Car Insurance Rates With Bad Credit in Kentucky Cities

If you have bad credit, where you live in Kentucky will be key in how much you pay for car insurance. Kentucky drivers with bad credit in Owensboro pay $186 a month for car insurance, while those in Louisville, one of the state's most well-known cities, pay on average more than $350 per month.

City | Credit Tier | Avg. Monthly Cost ⓘ |

|---|---|---|

| Louisville | Poor | $358 |

| Lexington | Poor | $229 |

| Bowling Green | Poor | $247 |

| Owensboro | Poor | $186 |

| Paducah | Poor | $252 |

| Richmond | Poor | $231 |

Insurance prices and policies can vary significantly between companies, and a state like Kentucky draws a wide variety of choices when factoring insurance rates for drivers with bad credit.

Insurify's rate comparison tool will help you make sure you're getting the best possible quote based on your needs and location. You can have peace of mind you're not paying any more than you need to, and customers save $585 per year on average.

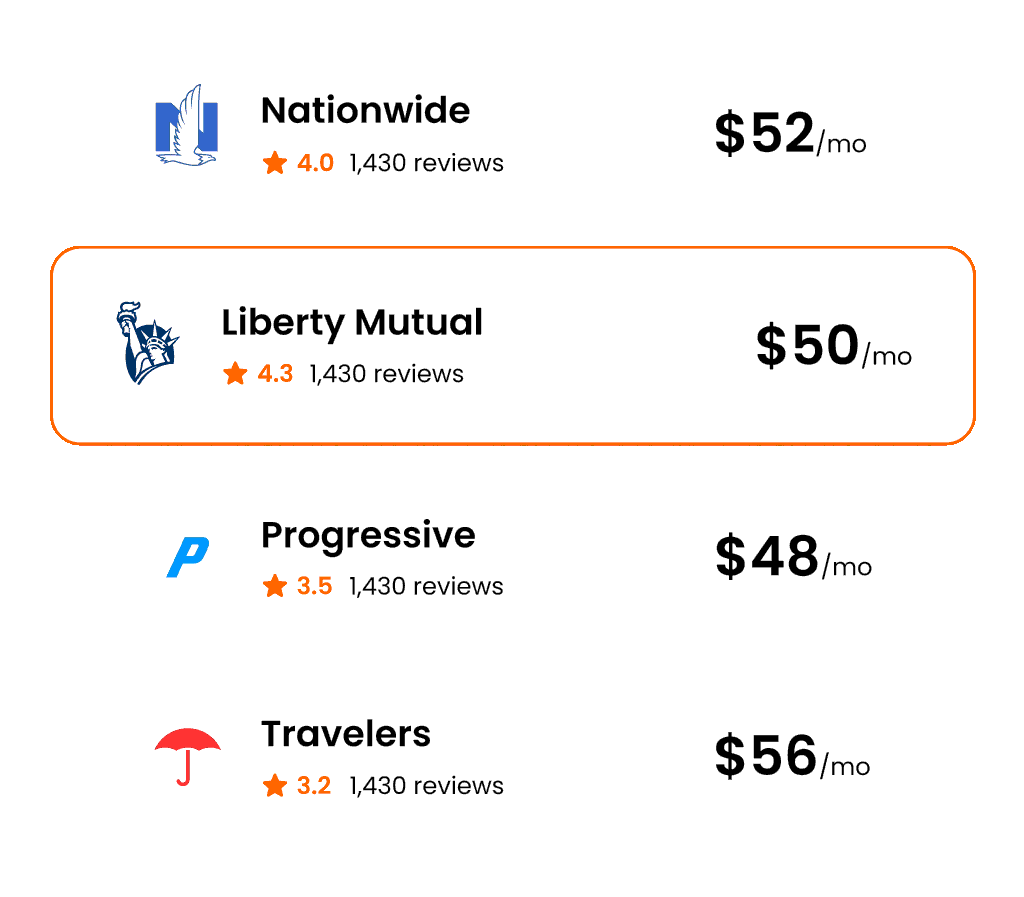

Compare Top Auto Insurance Companies

Use Insurify for all of your car insurance comparison needs! Compare and connect directly with the top insurance companies to find the best rates as well as the most personalized discounts and coverage options. Insurify’s network includes over 200 insurance companies throughout the U.S. who can work with you to get you the right auto insurance policy at the cheapest price. See All Auto Insurance Companies

FAQs - Kentucky Car Insurance

Why is car insurance so expensive in Kentucky?

There are many different factors that go into the how expensive your car insurance is. That said, some of the reasons why you could be paying so much for your insurance include: living in a state with high minimum insurance requirements, being a young or new driver, committing past traffic offenses like at-fault accidents or DUIs, and having a low credit score.

Do car insurance rates vary by county in Kentucky?

Auto insurance costs will vary between locations and insurance carriers, depending on the county Kentucky. Insurify analyzed the latest data for the five most populous cities in Kentucky to find you the cheapest quotes in each of these metropolitan areas.

Which providers have the best auto insurance ratings in Kentucky?

The way to find the carrier with the best auto insurance ratings in Kentucky and save on your insurance premiums is to compare quotes from all companies in your area. Use a car insurance quotes comparison site like Insurify to compare up to 10+ real quotes for your specific driver profile and unlock savings and discounts. Rates can fluctuate greatly based on whether you're a safe driver or a high risk one, but you should never overpay. Insurify provides the cheapest car insurance quotes and companies in your area in just a few seconds.

How much do annual auto insurance rates increase in Kentucky?

During the past three years in the United States, national premium costs have risen an average of 4.5 percent annually. In states where quotes have risen, this figure has been 7.8 percent; and in those where rates have fallen, prices have decreased by approximately 6.0 percent. Individual rates by state will of course vary depending on the driver’s history and a multitude of factors.

Methodology

Insurify data scientists analyzed more than 90 million quotes served to car insurance applicants in Insurify’s proprietary database to calculate the premium averages displayed on this page. These premiums are real quotes that come directly from Insurify’s 500+ partner insurance companies in all 50 states and Washington, D.C. Quote averages represent the median price for a quote across the given coverage level, driver subset, and geographic area.

Unless otherwise specified, quoted rates reflect the average cost for drivers between 20 and 70 years old with a clean driving record and average or better credit (a credit score of 600 or higher).

Liability-only premium averages correspond to policies with the following coverage limits:

- Bodily injury limits between state-minimum rates and $50,000 per person, $100,000 per accident

- Property damage limits between $10,000 and $50,000

- No additional coverage

- Comprehensive coverage with a $1,000 deductible

- Collision coverage with a $1,000 deductible

Quotes for Allstate, Farmers, GEICO, State Farm, and USAA are estimates based on Quadrant Information Services’ database of auto insurance rates.

Related articles

)

Cheap Car Insurance Quotes in Kentucky Starting at $97

)

Best Car Insurance in Kentucky

)

Kentucky Car Insurance Laws and Requirements

)

Average Car Insurance Cost in Kentucky

)

Can You Get an Anonymous Car Insurance Quote?

)

How to Find Cheap Commercial Auto Insurance

)

Pros and Cons of 12-Month Car Insurance Policies

)

Best Commercial Truck Insurance Companies

)

Best Cheap Car Insurance in Richmond, KY, from $85

)

Cheap Car Insurance in Owensboro, KY, Starting at $75

)

Cheapest Car Insurance Quotes in Paducah, KY

)

Cheapest Car Insurance Quotes in Louisville, KY

)

Cheapest Car Insurance Quotes in Lexington, KY

)

Cheap Car Insurance in Henderson, KY, Starting at $89

)

Cheapest Car Insurance Quotes in Elizabethtown, KY

)

Best Cheap Car Insurance in Bowling Green, KY, From $89

)

Joe Dyton has been a professional writer since 1999. He's been writing about the auto insurance industry for 15 years and was an in-house marketing copywriter for GEICO for a decade. Learn more about Joe at joedyton.com.

)

)

Licensed property and casualty insurance agent

8+ years editing experience

NPN: 20461358

John leads Insurify’s copy desk, helping ensure the accuracy and readability of Insurify’s content. He’s a licensed agent specializing in home and car insurance topics.

Featured in

)

Amber Benka is a licensed insurance agent specializing in auto, home, commercial, life, and health insurance. She has owned the R.A.L Insurance Agency for four years.

)

)