Full-time writer for 5+ years

Two-time Emmy Award nominee

A Harvard graduate, Mark has worked as a freelance personal finance and tech writer. He’s also written for Saturday Night Live.

Featured in

)

Property and casualty insurance specialist

4+ years creating insurance content

Tanveen manages Insurify's data insights, annual home and auto insurance reports, and media communications. She’s regularly featured in media interviews on insurance topics.

Featured in

Updated

At Insurify, our goal is to help customers compare insurance products and find the best policy for them. We strive to provide open, honest, and unbiased information about the insurance products and services we review. Our hard-working team of data analysts, insurance experts, insurance agents, editors and writers, has put in thousands of hours of research to create the content found on our site.

We do receive compensation when a sale or referral occurs from many of the insurance providers and marketing partners on our site. That may impact which products we display and where they appear on our site. But it does not influence our meticulously researched editorial content, what we write about, or any reviews or recommendations we may make. We do not guarantee favorable reviews or any coverage at all in exchange for compensation.

When it comes to shopping for insurance, you don’t want to buy the first policy you come across. Truly exploring the marketplace and comparing car insurance quotes is the best way to find a policy that meets your needs and budget. And sorting through all the different insurance companies doesn’t have to be a pain, thanks to today’s useful online quote-comparison tools.

No more shelling out cash for an insurance broker. Sites like Clearsurance have made it easier than ever to compare insurance carriers and help you make those crucial insurance decisions. Simply log on to Clearsurance.com, and you’ll be able to compare reviews and prices on home insurance, car insurance, renters insurance, and more.

Another site that has changed the game for insurance consumers is Insurify. Insurify makes insurance shopping easy by letting you compare quotes from a wide array of insurance companies. Simply answer a few questions, and Insurify will give you access to 10+ free quotes on a wide range of insurance policies.

More: How to Compare Car Insurance:

What is Clearsurance?

Clearsurance bills itself as a “true customer-first marketplace for insurance.” The site collects reviews and ratings from real customers so that you can confidently shop for an affordable policy that meets your specific needs. Clearsurance’s insurance rankings also help you zero in on the best insurance companies—and their quotes help you get a clear idea of pricing.

How does Clearsurance work?

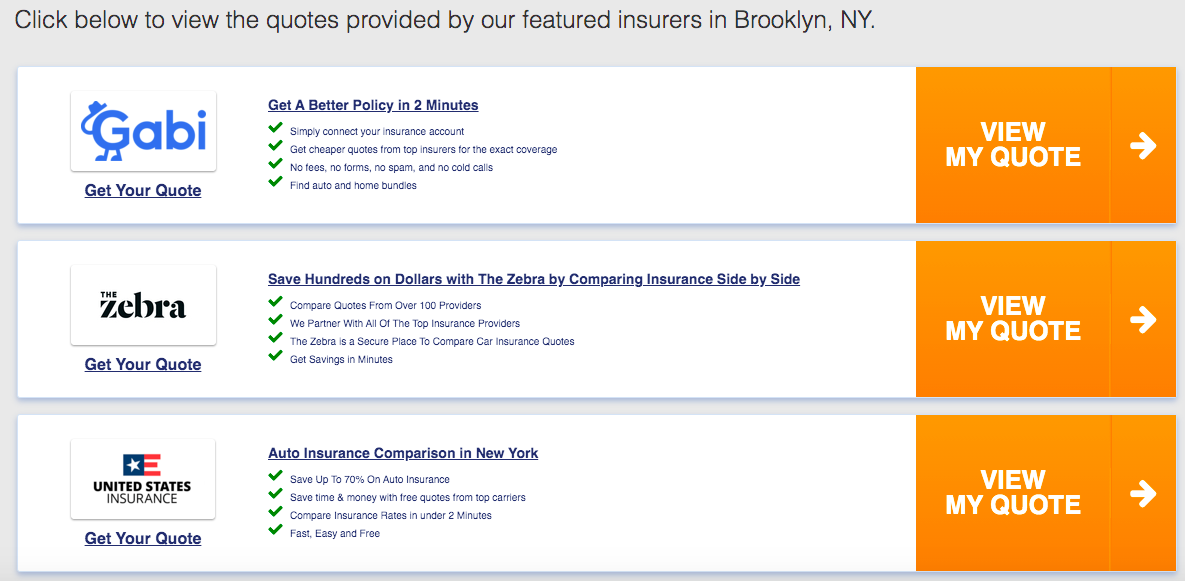

Clearsurance spares users the lengthy signup process and instead lets them get started right away by entering the type of insurance you’re looking for and your ZIP code. You have the option to compare prices from auto, home, health, life, and renters insurance companies.

More: Auto and Home Insurance Quotes

Then, it’s time to answer some simple questions about your car and your history on the road. To generate accurate insurance quotes, Clearsurance needs a clear idea of your driver profile.

Clearsurance will then connect you with one of their partner sites, which is where you will enter the email address you want your quotes sent to.

With these quotes delivered straight to your inbox, you can quickly get to work comparing insurers and finding the policy that works for you. And all of that was done in minutes after carefully entering your relevant information. Clearsurance is also committed to privacy and clarifies that your private data and information will not be shared with third parties.

More: Car insurance quotes

More: Cheap car insurance

Clearsurance Reviews: Here's what customers are saying…

So what do customers have to say about the Clearsurance user experience? Did the site really help them save money on insurance? We took a look at reviews on social media to get a better idea of what customers really think about Clearsurance.

While there aren’t many reviews on Facebook, the general evaluation regarding Clearsurance appears to be rather mixed, with an average rating of 2.7 out of 5 stars:

This user gets straight to the point, saying that they found Clearsurance to be an easy way to connect with the best insurance companies.

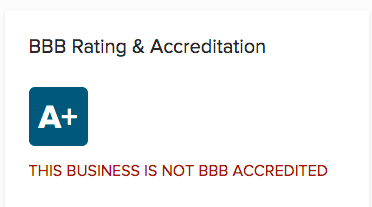

While Clearsurance isn’t accredited with the Better Business Bureau, it does have an A+ rating on the Better Business Bureau site. The company’s BBB page does not include any customer reviews.

As a fairly young company, Clearsurance is still garnering reviews from users. Based on Clearsurance’s Facebook reviews, it seems the company pleases some users but leaves others unsatisfied.

Clearsurance vs. Insurify: The Facts

While Clearsurance and Insurify promise to help users find more affordable insurance policies, how do these two quote-comparison options stack up against each other?

User Experience: Clearsurance and Insurify offer a fairly similar user experience. Both avoid drawn-out signup processes and instead let users get started right away. And both websites enable you to access quotes in seconds after answering questions about your vehicle and driver history.

Policy options: Insurify places an emphasis on quotes from car insurance companies and homeowners insurance companies. The Insurify blog also provides a wealth of content about health, life, and renters insurance. Meanwhile, Clearsurance enables users to compare auto, home, life, health, and renters insurance quotes.

Expertise: While both websites have satisfied many users, Insurify has been in the quote-comparison game a bit longer than Clearsurance. Insurify has served millions of users, has a user rating of 4.8 out of 5 stars, and won Best Insurance Company honors in 2016 and 2017.

Privacy: Both websites take user privacy very seriously. Insurify lets users know that their data is encrypted and never sold to third parties. Clearsurance and Insurify also never spam you with emails and texts. Insurify even enables you to manually schedule when you receive email and text notifications from them.

Clearsurance vs. The Zebra

The Zebra has been a major player in the insurance-comparison space for years now. But how does The Zebra compare to Clearsurance?

Both market themselves as unbiased, independent tools that help drivers and homeowners find the best insurance companies for their personal needs. The Zebra and Clearsurance also provide a similar user experience, enabling users to simply enter their ZIP code to get up and running. And after you enter your information, both sites promise to never spam you.

One difference between these insurance tools is that The Zebra only enables you to research home and auto insurance, while Clearsurance gives you the option to access quotes for auto, home, renters, life, and health insurance.

Clearsurance vs. Jerry

Jerry is a fast-growing online “insurance shopper” that contacts your current insurance company to figure out your coverage details, then compares this price to prices from up to 45 other insurance companies. While Jerry is similar to Clearsurance in that it makes it easier to compare quotes, it’s aimed at people who already have insurance and want to check if there are better options out there.

In general, Clearsurance is a better choice if you’re buying car insurance for the first time, while Jerry is better if you’re about to renew your policy and want to check the lay of the land. That said, neither compares to Insurify when it comes to easy, comprehensive quote comparison. With Insurify, you’re just a few clicks away from insurance quotes from a wide range of carriers.

How to Save on Car Insurance

One of the easiest ways to save on car insurance is by driving responsibly. Avoiding accidents and traffic violations lets car insurance companies know you’re unlikely to file a claim. Investing in safety features like anti-lock brakes and taking a defensive driving course are great ways to improve your driving skills—and lower your insurance premiums.

But an even easier way to lower your car insurance costs is by comparing quotes from a wide range of insurance companies. Insurify makes this easy, putting all the key insurance pricing information you need in one place. Just answer a few questions about your vehicle and driving history, and Insurify will help you access dozens of quotes from carriers big and small.

More about Clearsurance

Clearsurance was founded in 2016 by Michael Crowe, an insurance professional who teamed up with talented people from the worlds of tech and insurance to simplify the insurance shopping experience. Just a year after its founding, over 50,000 policyholders had used Clearsurance to share their insurance experiences and help others looking for policies.

Contact information

Official Website: www.clearsurance.com

Facebook: www.facebook.com/Clearsurance/

Twitter: twitter.com/clearsurance

LinkedIn: www.linkedin.com/company/clearsurance/

Email: [email protected]

Phone Number: 1 (888) 901-2754

Mailing Address: Clearsurance, Inc., 15310 Amberly Dr Suite 250, Tampa, FL 33647

Frequently Asked Questions

Is Clearsurance legit and safe to use?

Clearsurance features over 150,000 authentic reviews from real policyholders. The Clearsurance site also makes clear that the company does not spam users or share their data with third-party companies. Overall, there’s nothing to suggest that Clearsurance isn’t perfectly safe to use.

What types of insurance can Clearsurance compare?

Clearsurance gives users the option to compare prices from auto, home, health, life, and renters insurance companies.

What are the differences between Clearsurance and Insurify?

While Clearsurance and Insurify both help drivers and homeowners find great deals on insurance, Insurify has a longer track record of serving customers. Insurify’s website also places an emphasis on connecting policyholders with possible discounts, which is less of a focus for Clearsurance.

If you’re looking for a new insurance policy, you’ll want to check out Insurify. With an easy-to-use interface and a wealth of proprietary insurance-quote data, Insurify is the easiest way to quickly find a policy that meets your needs and budget.

Methodology

Insurify data scientists analyzed more than 90 million quotes served to car insurance applicants in Insurify’s proprietary database to calculate the premium averages displayed on this page. These premiums are real quotes that come directly from Insurify’s 500+ partner insurance companies in all 50 states and Washington, D.C. Quote averages represent the median price for a quote across the given coverage level, driver subset, and geographic area.

Unless otherwise specified, quoted rates reflect the average cost for drivers between 20 and 70 years old with a clean driving record and average or better credit (a credit score of 600 or higher).

Liability-only premium averages correspond to policies with the following coverage limits:

- Bodily injury limits between state-minimum rates and $50,000 per person, $100,000 per accident

- Property damage limits between $10,000 and $50,000

- No additional coverage

- Comprehensive coverage with a $1,000 deductible

- Collision coverage with a $1,000 deductible

Quotes for Allstate, Farmers, GEICO, State Farm, and USAA are estimates based on Quadrant Information Services’ database of auto insurance rates.

Related articles

)

The Zebra Car Insurance Review: Consumer Reviews, Quotes

)

QuoteWizard Car Insurance Review: Consumer Reviews, Quotes

)

OTTO Insurance Reviews

)

Pretected Auto Insurance Reviews

)

Nsure Car Insurance Review: Consumer Reviews, Quotes

)

LendingTree Car Insurance Review: Consumer Reviews, Quotes

)

Jerry Insurance Reviews: Consumer Reviews, Quotes

)

Insure.com Car Insurance Review: Consumer Reviews, Quotes

A.M. is a Brooklyn-based writer, editor, and content marketing strategist who's worked with major brands in insurance, tech, finance, and healthcare. He also contributes to The Average Joe, a personal finance newsletter that reaches over 250,000 daily readers. Since 2019, he's written for Insurify, breaking down a diverse range of insurance topics into crisp, readable prose.

A.M. has been a contributor at Insurify since December 2022.

)

Property and casualty insurance specialist

4+ years creating insurance content

Tanveen manages Insurify's data insights, annual home and auto insurance reports, and media communications. She’s regularly featured in media interviews on insurance topics.

Featured in

)