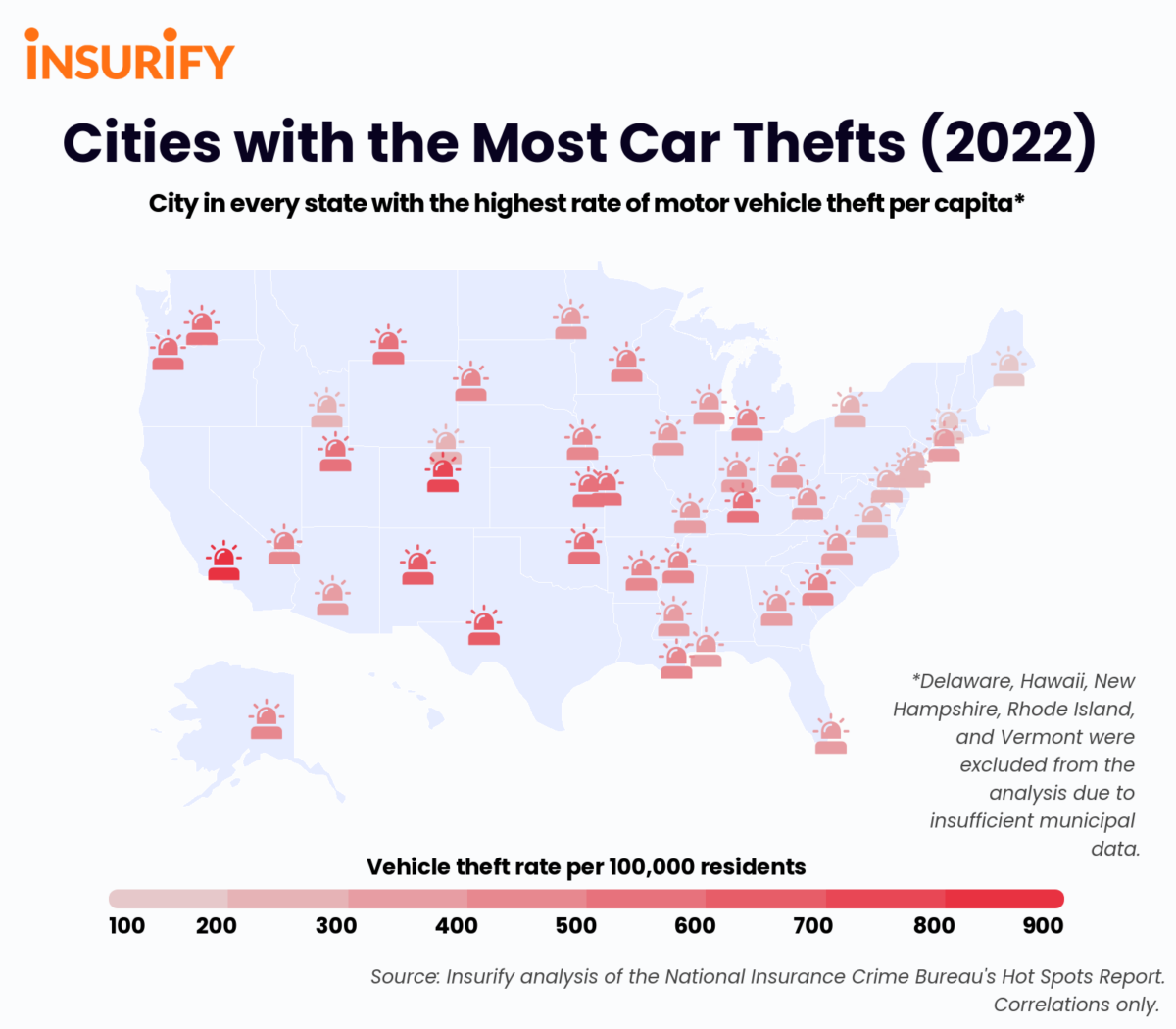

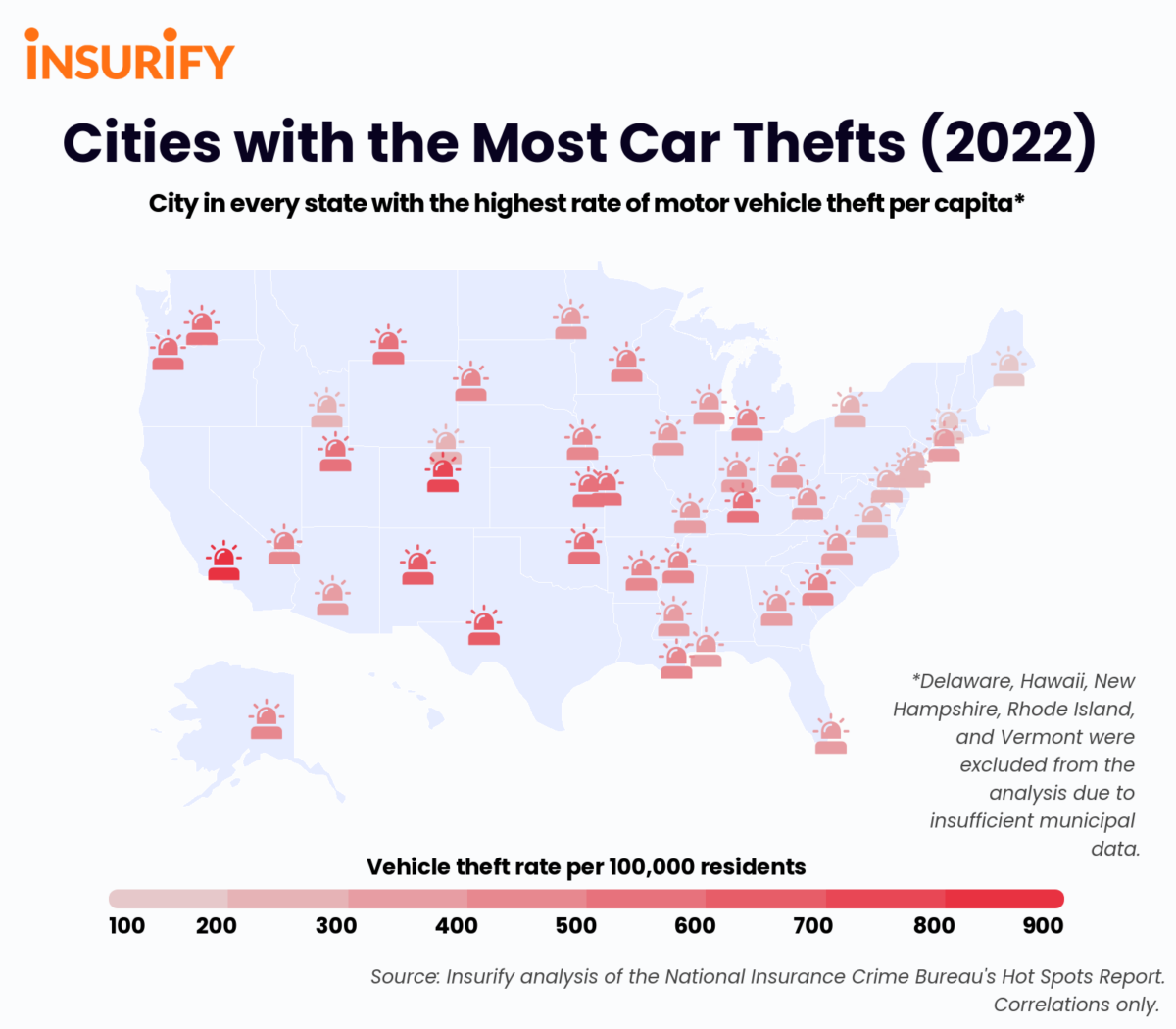

When it comes to car theft, the nation’s biggest cities may make the most headlines, but every state has areas where drivers should take extra precaution to secure their vehicle.

Car theft is a major concern for many American drivers and for good reason: there are more than 880,000 vehicle thefts each year across the United States, according to the most recent data from the National Insurance Crime Bureau’s (NICB) Hot Spots report. To put this huge number in perspective, an average of one vehicle is stolen in the U.S. every 36 seconds.

While the country’s biggest cities have a reputation for being carjacking hotbeds, the reality is that car theft poses a risk to drivers everywhere, especially since the beginning of the COVID-19 pandemic. The NICB notes that the pandemic created multiple national crises — including an economic slump and diminished school and social programming — that correlate with increased car theft rates. In America, the total number of vehicles stolen rose 11% between 2019 and 2020, marking a sharp departure from several years of modest declines in carjackings. With theft rates on the rise, drivers should be vigilant about locking their car and keeping valuables out of sight, especially in areas of higher risk. Drivers who have unfortunately fallen victim to car theft can take steps such as filing a police report, having the right paperwork on hand when talking to their insurance company, and remembering to file a stolen vehicle report with the DMV as well.

Curious to see where carjackings are most common in every state, the data scientists at Insurify analyzed NICB data to identify the city in each state with the highest car theft rate.

Methodology

The data scientists at Insurify, a car insurance comparison site, compiled data from the National Insurance Crime Bureau’s (NICB) most recent Hot Spots report on auto theft rates in 382 Metropolitan Statistical Areas (MSA’s) across the United States. From this data, they identified the metro area in every state reporting the highest auto theft incidence per 100,000 residents, as well as the top ten cities overall with the highest auto theft rates. The data scientists identified these MSA’s as the cities with the most car thefts in 2022. Due to insufficient metropolitan area data, Delaware, Hawaii, New Hampshire, Rhode Island, and Vermont were excluded from this analysis.

Population data for each metro area was gathered from the United States Census Bureau.

The findings in this article represent statistical trends found in Insurify’s analysis of the National Insurance Crime Bureau’s Hot Spots data. The findings of this study are not meant to imply the direction nor necessarily the existence of a causal relationship. Rather, this is a presentation of statistical correlations of public interest.

10 U.S. Cities With the Most Car Thefts Per Capita

1. Bakersfield, CA - Motor vehicle thefts per 100k residents: 905

2. Yuba City, CA - Motor vehicle thefts per 100k residents: 724

3. Denver, CO - Motor vehicle thefts per 100k residents: 706

4. Odessa, TX - Motor vehicle thefts per 100k residents: 664

5. San Francisco, CA - Motor vehicle thefts per 100k residents: 655

6. Albuquerque, NM - Motor vehicle thefts per 100k residents: 632

7. Pueblo, CO - Motor vehicle thefts per 100k residents: 602

8. Billings, MT - Motor vehicle thefts per 100k residents: 565

9. Tulsa, OK - Motor vehicle thefts per 100k residents: 552

10. San Jose, CA - Motor vehicle thefts per 100k residents: 551

Sources

Data Attribution

The information, statistics, and data visualizations on this page are free to use, we just ask that you attribute any full or partial use to Insurify with a link to this page. Thank you!

If you have any questions or comments about this article or would like to request the data, please contact [email protected].

)

)

)

)

)

)

)