How can i get homeowners insurance after non-renewal?

First, you should try contesting the non-renewal decision. If that doesn't work, you should use an insurance marketplace to research the best policies available to you. Finally, you should also consider your state's FAIR plan for affordable policies.

One or two months before the end of your homeowners insurance policy term, your homeowners insurance company will let you know whether your policy is up for renewal. If it’s not, you’ve been “non-renewed”—informed that the home insurance company won’t renew your policy.

It may seem like a short period of time, but a month or two is enough to find new insurance coverage for your home. Start by reviewing our guide to finding insurance after a non-renewal, then find a new insurer with Insurify, a simple tool that helps you compare home insurance quotes for home insurance.

Insurance Cancellation vs. Insurance Non-Renewal

First, it’s important to understand whether your policy was canceled or non-renewed. There’s a difference. The biggest difference is that insurance companies can’t cancel a policy that has been in effect for more than 60 days unless one of two things has happened:

Non-renewal is different. Either you or the insurance company can choose not to renew the policy if it’s about to expire. If the insurance company is the one non-renewing, they are required to give you a certain number of days’ notice by state law. The number of days varies by state—for example, in New York, it’s 45–60 days, and they must give you a reason as well. In Florida, the company has to send a non-renewal notice at least 100 days before the policy expires and must include a reason.

Why Homeowners Policies Are Non-Renewed

There could be many reasons behind your insurance non-renewal. Be sure to understand exactly why your home insurance was denied so that you can proceed accordingly.

One key reason is that the insurance carrier isn’t offering that coverage any longer. They may have decided to drop that line of insurance, or they may not be offering policies in your state or region anymore in the name of making higher profits. Many policyholders are non-renewed for this reason, and it doesn’t mean you did anything wrong. You may even be able to find a policy with a competitor that costs the same or less. Getting non-renewed doesn’t always mean higher premiums.

It’s also possible that you filed too many insurance claims. Your claims history is one of the most common reasons for insurers to drop people from their policies. You may have filed too many claims—even small claims —within a certain window of time, or you may have filed too many claims in a certain category, like fire, water damage, or dog bites.

The insurance company may also non-renew your policy if your risk has changed significantly. In other words, your home is more likely to be damaged by a covered peril than it was when you got the policy. This might mean that a home inspection has revealed unacceptable risks, or you’ve made changes to your home that violate the terms of the policy. You may have simply added a home-based business, which requires different insurance. This type of non-renewal is also often used in areas at high risk for wildfires or hurricanes.

Non-Renewal and Consumer Protection

Most states have consumer protections in place that say when a company is allowed to raise your premiums or non-renew your policy for claim-related reasons. For example, some states bar insurance companies from raising your rates after your first claim or any claims that didn’t require a payout (also known as zero-dollar claims).

Some states also don’t let companies use weather or natural disasters as a reason to non-renew. Contact your state’s insurance department to learn more about state-specific consumer protection and other insurance information.

How to Get Homeowners Insurance After Non-Renewal

Getting a non-renewal isn’t the end of the world. You can find a new home insurance policy after your policy is non-renewed.

Know that your mortgage lender will find an insurer to cover your home on your behalf if your policy lapses, no matter the reason. Do whatever you can to avoid this because lender-placed policies (also known as lender-forced policies) usually have higher premiums and worse coverage than what you can find on your own.

For example, a lender -placed policy will probably have adequate dwelling coverage but fall short on protecting your possessions because the lender has no reason to care about what happens to your personal belongings.

If your policy is non-renewed, here’s how to get covered again.

1. Contest the non-renewal decision. Contact your insurance provider and explain why you think the non-renewal was unjust. Winning this appeal generally hinges on proving that your house isn’t as risky as the insurer thinks it is. Maybe your state has a lot of variation in climate risks within a small geographical area, so risk exposure varies from block to block. If you can prove this, you might be able to get your insurance back. You can also prove that you’ve mitigated your risk exposure by replacing the roof or performing other upgrades that lower your vulnerability to major risks.

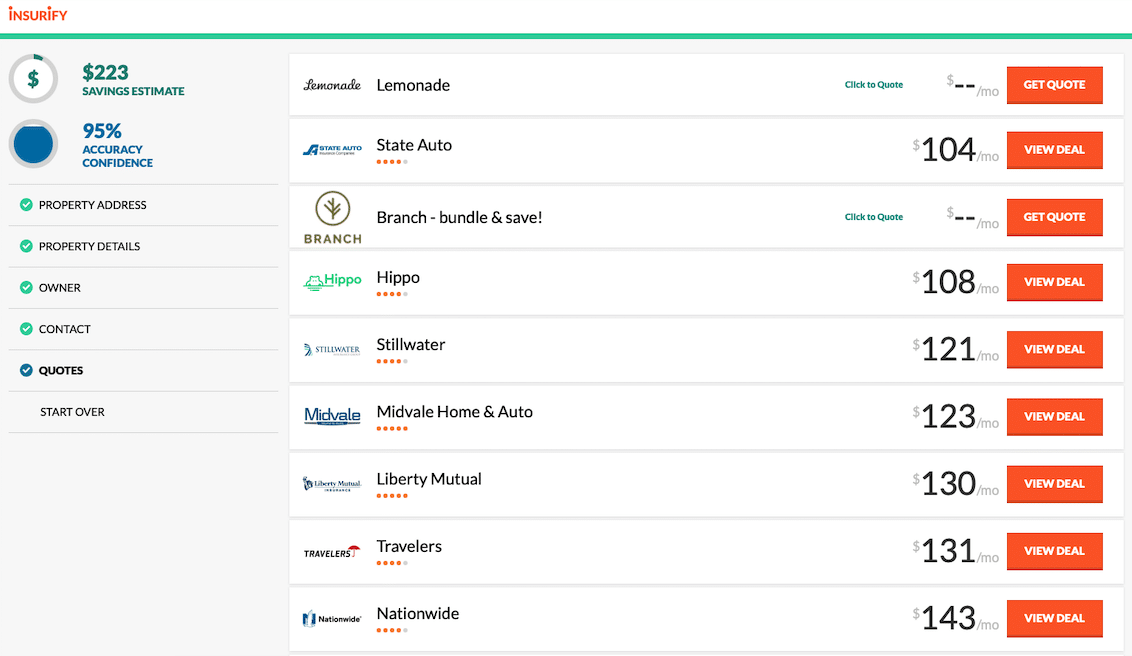

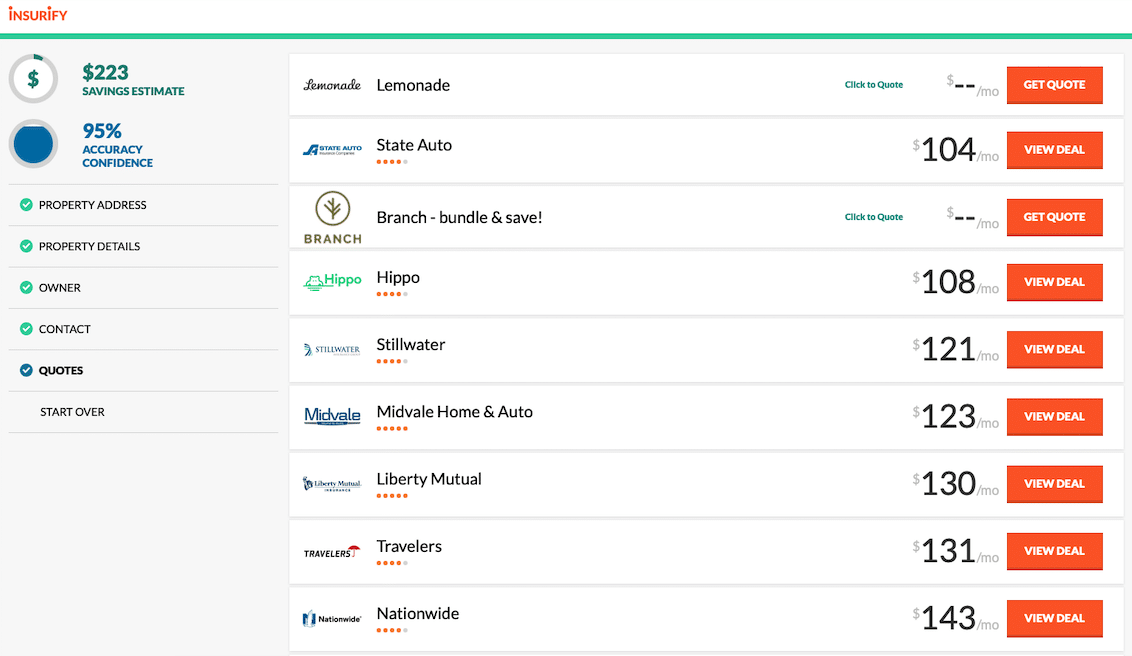

Use an insurance marketplace. Use tools like Insurify to compare quotes from different insurers. You can do your research in just a few minutes and apply for your new insurance online.

Buy into your state’s FAIR Plan. Having trouble finding private coverage? Most states have a FAIR ( Fair Access to Insurance Requirements ) Plan, a high-risk insurance pool administered by the state’s department of insurance and funded by private companies. Each state has different requirements for approval. For example, some of them require you to prove that you’ve been turned down by at least three insurance companies before you can get a FAIR Plan. These last-resort plans also have strict limits that you won’t find with private plans. For example, they typically don’t have liability protection or additional coverage for valuables, and personal property is usually only covered at its actual cash value.

Conclusion: Act Now to Reinsure Your Home

You can get insurance again after a non-renewal, but it’s important to act fast. Take action immediately to avoid getting stuck with a lender -forced policy.

Find your new policy with Insurify, an easy-to-use tool that delivers quotes from multiple insurers in just a few minutes. Still have questions? One of our talented and compassionate insurance agents is ready to assist you.

Use Insurify, a home insurance comparison site to find the best rate for your property.

)

)

)

)

)